In Texas, who inherits when there is no will?

When someone dies intestate (i.e., without a will), their assets are inherited by their "heirs" as determined by Texas Estates Code.

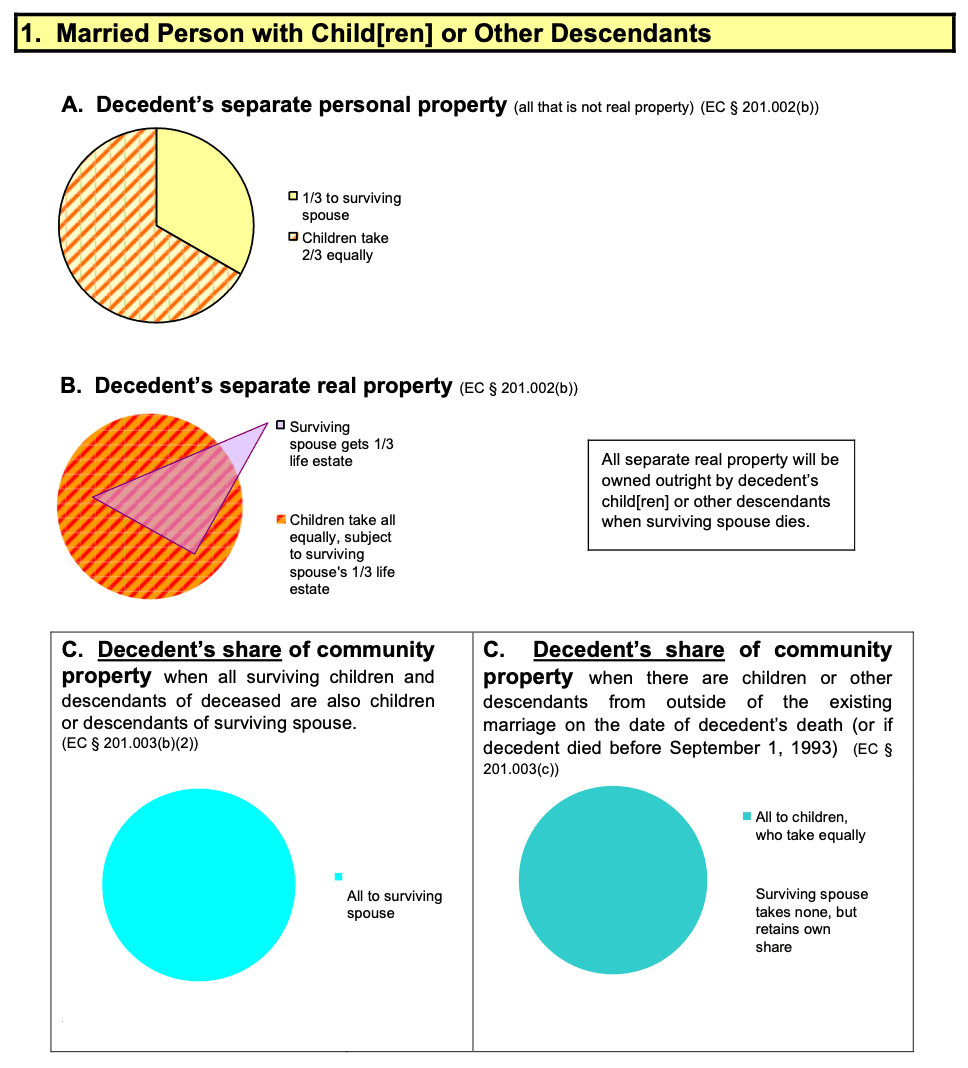

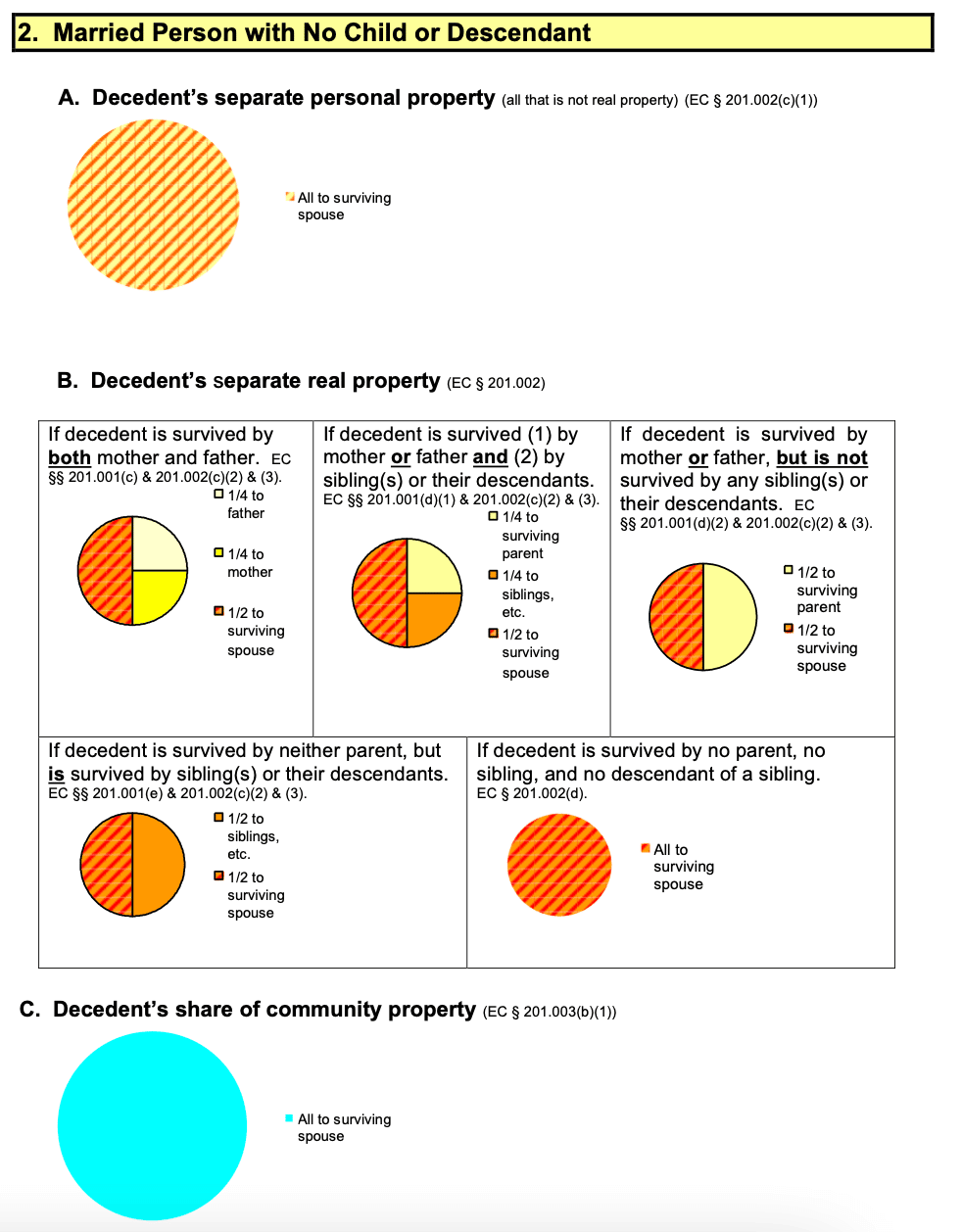

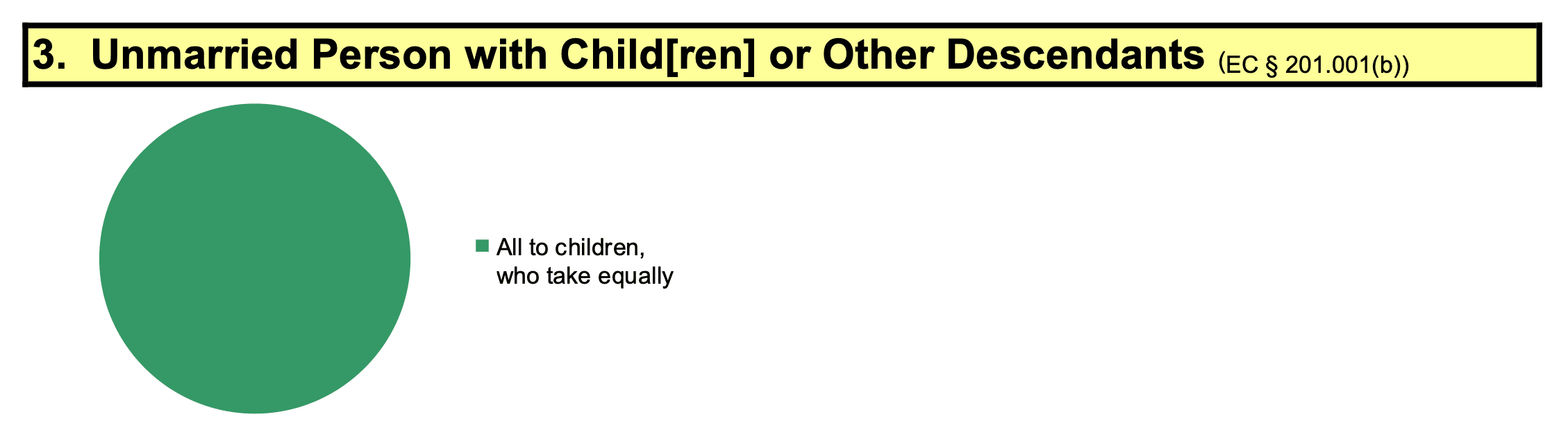

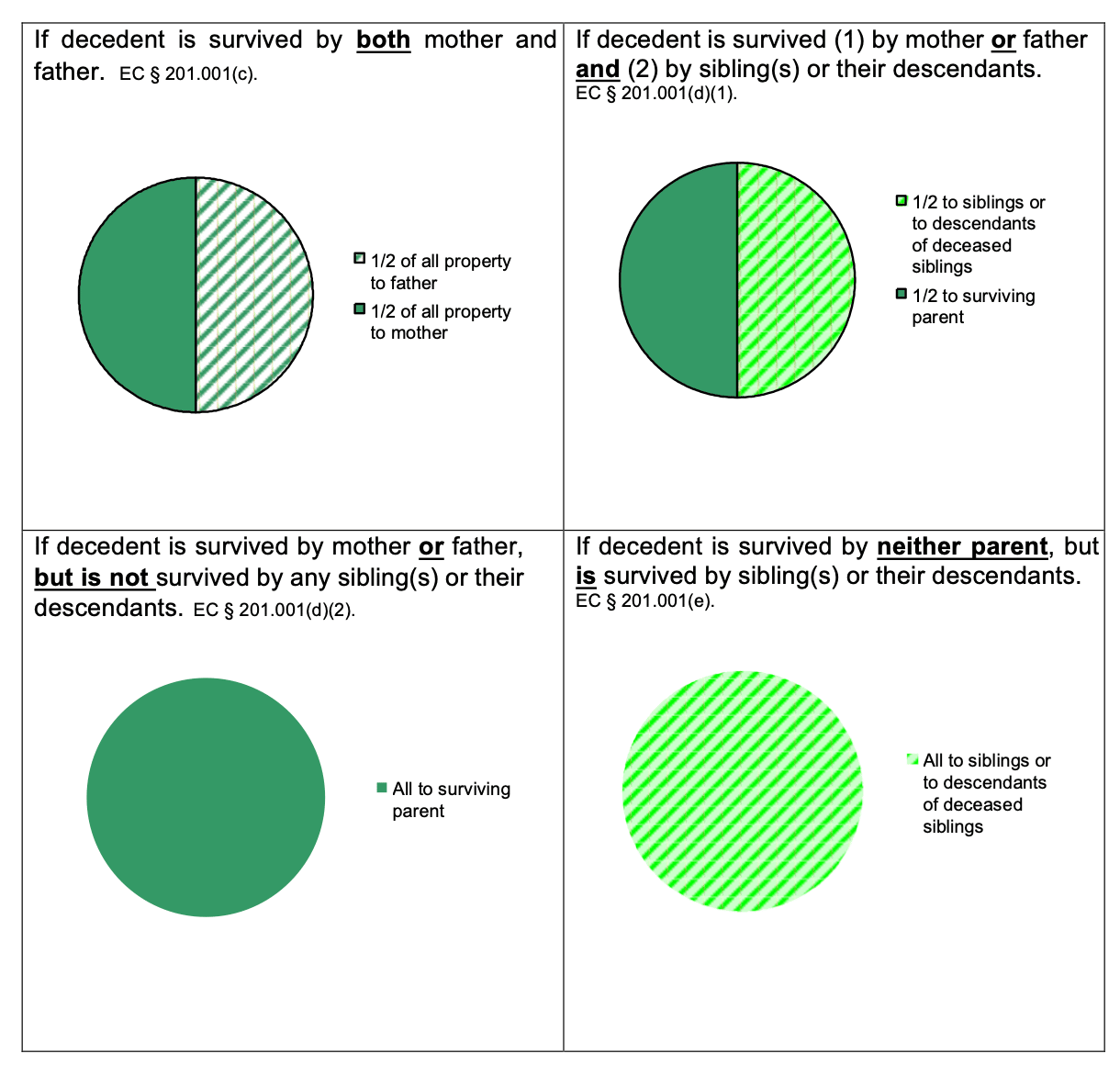

The determination of a decedent's heirs depends on whether or not the decedent had: (1) a spouse; (2) children; (3) surviving parent(s); and/or (4) siblings. Every intestate decedent falls into one of 4 categories:

Does a spouse inherit everything?

Not necessarily. The general rule is fairly straight forward as it relates to community property in that the surviving spouse will inherit the deceased spouse's undivided one-half interest in the community property IF AND ONLY IF (1) the deceased spouse had no children or no child or other descendant of the deceased spouse survives the deceased spouse; or (2) all of the surviving children and descendants of the deceased spouse are also children or descendants of the surviving spouse.

For separate property, you will need to consult one of the charts above.